Manufacturing CEOs Topics in Q3 in 2025: Tariffs, AI Agents, and the Automation Roadmap

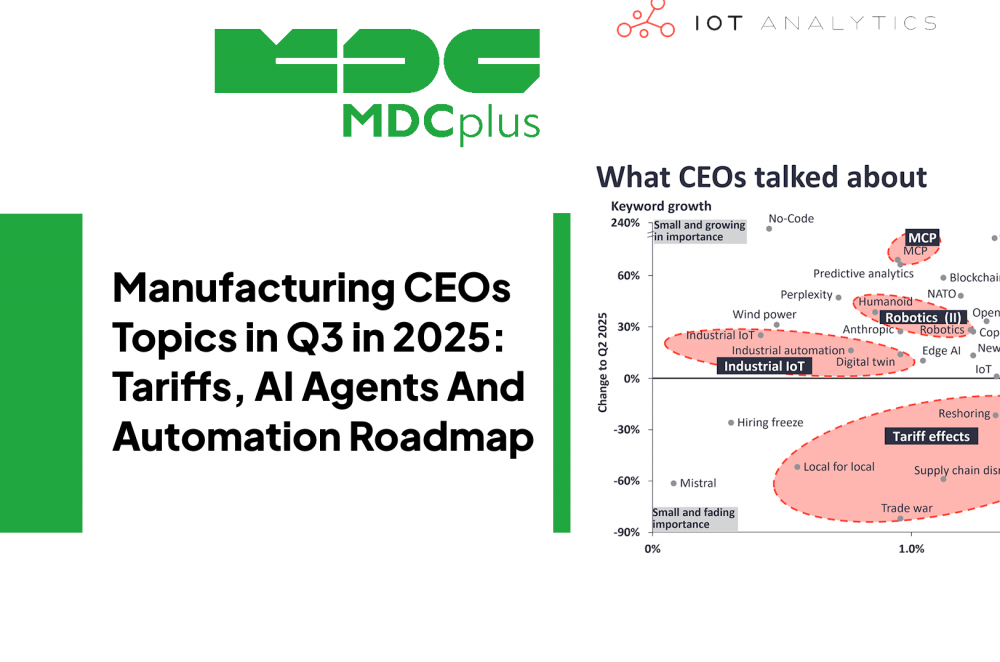

Every quarter, earnings calls offer a window into the priorities of global executives. The latest Q3 2025 “What CEOs Talked About” report from IoT Analytics highlights three big shifts: tariffs are settling into business reality, digital transformation is accelerating, and automation — from data centers to robotics — is moving from pilot projects to strategy.

For manufacturers, these themes aren’t abstract. They directly affect investment priorities, supply chain strategies, and technology adoption on the shop floor.

Tariffs: From Shock to Management

In Q2 2025, tariffs dominated CEO conversations as a disruptive shock. By Q3, the tone has shifted. Mentions of tariffs fell nearly 30% quarter-over-quarter. The reason? Companies are normalizing tariff strategies — dual sourcing, regionalized production, and structured pricing adjustments.

Executives from firms like Sandvik and Goodyear noted that while tariffs remain painful, they have “executed swift responses” and offset the financial hit. For manufacturers, the lesson is clear: tariffs are no longer a temporary storm — they’re a permanent feature of global trade. Building resilience through nearshoring and flexible supplier bases is no longer optional.

Data Centers and Energy Pressure

One of the fastest-rising themes is data center demand. Mentions jumped 15% in earnings calls, reflecting how cloud and AI adoption is reshaping industrial IT infrastructure. Utilities and construction firms, in particular, flagged strong order growth from hyperscale data center projects.

But alongside opportunity comes a warning: energy demand. Leaders from Belden and Legrand noted that large-scale data centers are “capacity constrained” and facing “major challenges on the energy management side.” For manufacturers, the takeaway is twofold:

-

Data infrastructure is now part of the supply chain. Every plant that runs advanced MES, ERP, or AI tools relies on the same capacity crunch driving data center demand.

-

Energy efficiency will become a differentiator. Products and services that reduce energy bills are increasingly winning favor with customers scaling digital infrastructure.

Agentic AI and AI Agents

AI was discussed in 45% of earnings calls in Q3, its highest level yet. But the sharpest growth came from agentic AI — autonomous AI agents that don’t just generate text, but take action in workflows. Mentions of agentic AI rose 40% quarter-over-quarter.

Executives like Goldman Sachs’ David Solomon described pilots where AI agents act as “autonomous developers,” supervised by engineers but trusted to execute software tasks at speed. The Model Context Protocol (MCP), a standard for AI agent interoperability, is also gaining traction.

For manufacturing leaders, the signal is unmistakable: AI agents are moving from labs to boardrooms. They won’t replace operators, but they will increasingly handle documentation, reporting, procurement, and compliance workflows — the kind of hidden overhead that eats margins.

Robotics: The Next Wave

Robotics also gained attention, particularly AI-driven robotics and humanoids. Mentions grew 28% quarter-over-quarter, with manufacturing showing the highest engagement (11% of companies).

The applications CEOs are most excited about span across EV production, warehouse automation, electronics, and aerospace. The rise of humanoids — robots designed to handle general-purpose tasks — is particularly notable, signaling a shift from single-task industrial robots toward flexible, human-adjacent machines.

For factories under workforce pressure, this trend connects directly to productivity and uptime. Cobots, AI-enabled robotics, and eventually humanoids are positioned not as replacements, but as capacity multipliers.

What It Means for Manufacturing Leaders

The Q3 2025 earnings calls show a digital agenda that’s no longer optional. For manufacturing executives, four questions stand out:

- Are your tariff strategies built into pricing, sourcing, and capacity planning — or are you still firefighting?

- Do you have a roadmap for AI adoption, moving beyond pilots into measurable ROI use cases?

- How will you integrate automation and robotics into your 12–18 month operations plan, balancing ROI with workforce change management?

- Is your data and energy strategy keeping pace with the demands of AI and connected production?

These aren’t side issues anymore. They’re now shaping how the best manufacturers plan, invest, and compete.

The conversations at the top — tariffs, AI agents, robotics, and data centers — are not about distant strategy. They’re about the operating environment every manufacturer faces today. The winners will be the plants that translate these boardroom themes into practical investments in resilience, automation, and digital performance on the shop floor.

About MDCplus

Our key features are real-time machine monitoring for swift issue resolution, power consumption tracking to promote sustainability, computerized maintenance management to reduce downtime, and vibration diagnostics for predictive maintenance. MDCplus's solutions are tailored for diverse industries, including aerospace, automotive, precision machining, and heavy industry. By delivering actionable insights and fostering seamless integration, we empower manufacturers to boost Overall Equipment Effectiveness (OEE), reduce operational costs, and achieve sustainable growth along with future planning.

Ready to increase your OEE, get clearer vision of your shop floor, and predict sustainably?